santa clara property tax appeal

Appeal of Supplemental or Escape Assessment within 60 days from the date of the assessment. I would recommend them anytime for tax appeal needs.

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

County of Santa Clara Department of Tax and Collections 852 N 1st.

. Santa Clara County repeals fee for property assessments. I had a fantastic experience getting my property tax deal processed through TaxProper. February 2020 Residential Property Assessment Appeals 1.

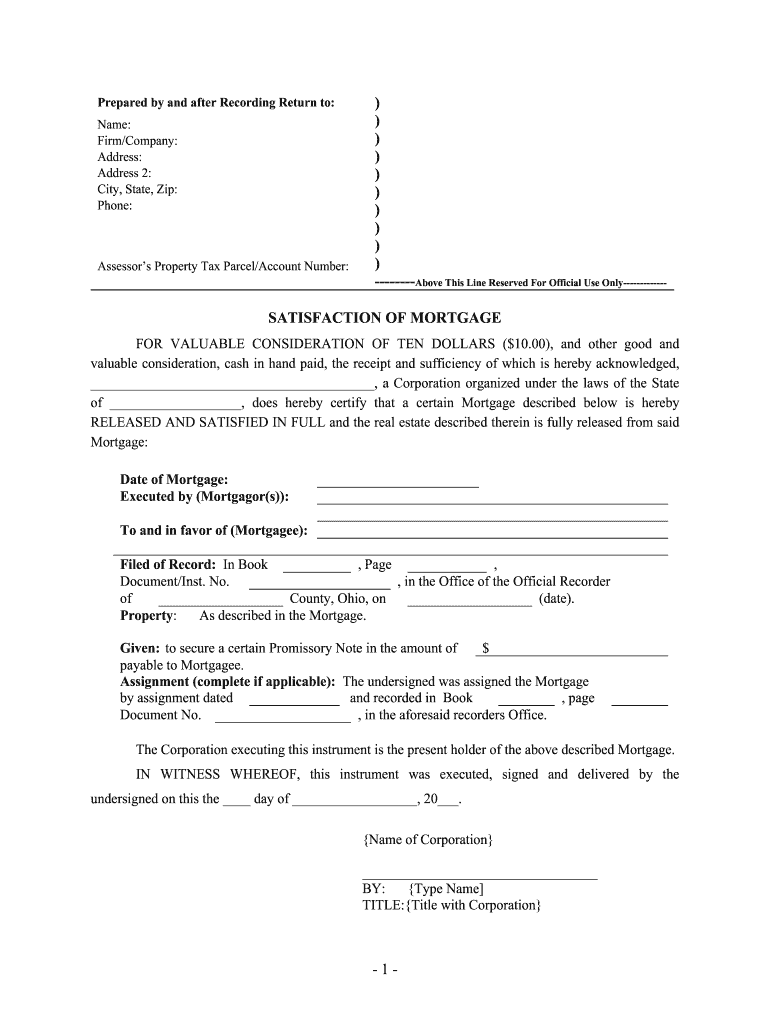

Appeal applications must be filed between July 2 to September 15 with the Clerk of the Board. Property Tax Email Notification lets you. Karthik saved 38595 on his property taxes.

Browse HouseCashins directory of Santa Clara top tax advisors and easily inquire online about their property tax protest consulting services. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections. Describe in detail the reasons for filing this claim and attach all supporting documentation.

The clerks of county assessment appeals boards and county boards of equalization have certified the assessment appeals filing period for their counties pursuant to the requirements of Revenue and Taxation Code section 1603. If you have questions or need assistance please call 408 808-7900 from 900 AM to 400 PM on Monday-Friday or email at DTAC-CancelPenaltyfin. Looking for the best property tax reduction consultant in Santa Clara California to help you with property tax appeal.

Penalty Amount APN for Secured Property. Street San Jose CA 95112. Disaster or Calamity Relief Section 170 Print Mail Form.

If you have any questions please call 408-808-7900. Or Assessment Number for Unsecured Property. COUNTY ASSESSMENT APPEALS FILING PERIODS FOR 2021.

If you have questions or need assistance please call 408 808-7900 from 900 AM to 400 PM on Monday-Friday or email at DTAC-CancelPenaltyfin. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated. The process was simple and uncomplicated.

Find the right Santa Clara Property Tax Appeals lawyer from 2 local law firms. The regular appeals filing period will begin on July 2 2021 in each county and will end. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in eliminating the fee for filing an appeal altogether.

Appeal of Regular Assessment during the Regular Filing Period July 2 September 15. Appeal forms and additional information pertaining to assessments appeals may be obtained from the Clerk of the Board of Supervisors 10th Floor County Government Center East Wing. If the appeal results in a reduction of taxes you will receive a refund if the tax has been paid.

If the last day of the filing period falls on a weekend or holiday an application filed on the next business day shall be deemed timely filed. Property taxes are levied on land improvements and business personal property. Introduction The property taxes you pay are based on your propertys assessed value as determined by your County Assessor.

Correctlys property tax appeal experts help Santa Clara County property owners challenge their assessed value and reduce their property tax bill. Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information. Or Assessment Number for Unsecured Property.

A secured property tax bill is generally a tax bill for real property which could include your home vacant land commercial property and the like. Attach documentation that supports the basis of your request to cancel your tax penalty. Agricultural Preserve Williamson Act Questionnaire.

The tax is a lien that is secured by the landstructure even though no document was. If you disagree with the Assessors value you can usually appeal that value to your local assessment appeals board or county board of equalization. If your taxes are increased you will receive an additional bill.

REDUCE PROPERTY TAXES. Please note the review process may take 45-90 days. The term secured simply means taxes that are assessed against real property eg land or structures.

Please note the review process may take 45-90 days. TaxProper did a great job answering any questions I had about the process and their service. Parcel Boundary Change Request.

Sign and date the form and submit online or by mail. Welfare Exemption Claim Form BOE-267. Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax professionals CPAs Attorneys and appraisers appointed by the Santa Clara County Board of Supervisors.

Public Portal Santa Clara County Signnow

California Public Records Public Records California Public

Property Taxes Department Of Tax And Collections County Of Santa Clara

Search Results Archives Santa Clara County Board Of Supervisors

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

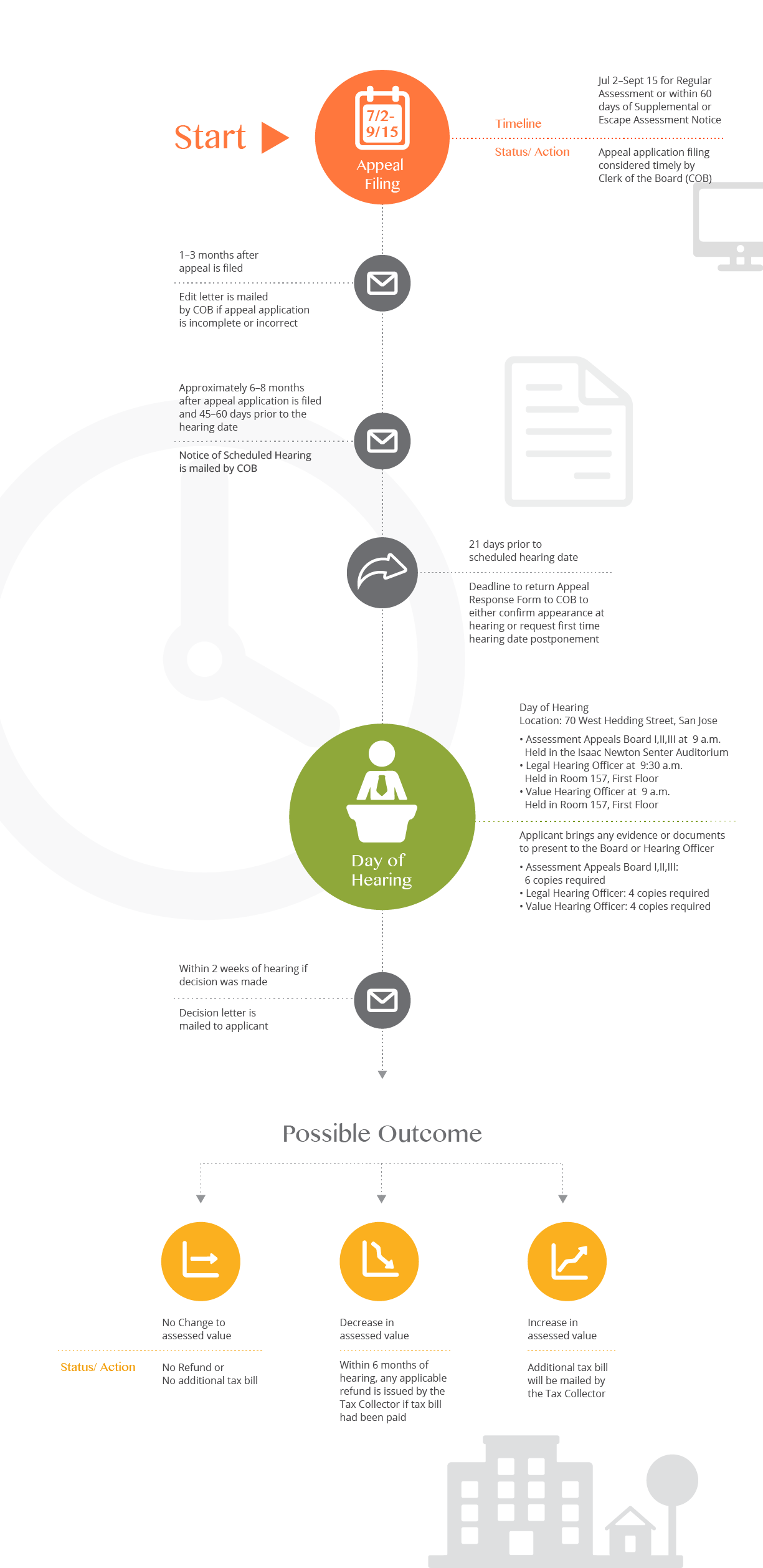

Roll Close Media Release 2021 Assessment Roll Growth Slows To 25 4 Billion But Escapes Worst Covid Projections

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Search And Records Propertyshark

Boutique Hotel In Valencia Palacio Santa Clara Autograph Collection

Santa Clara County Ca Property Tax Search And Records Propertyshark

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Property Taxes Department Of Tax And Collections County Of Santa Clara

Health Coverage Medi Cal Social Services Agency County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

Search Results Archives Santa Clara County Board Of Supervisors

Santa Clara Shannon Snyder Cpas

Santa Clara County Ca Property Tax Search And Records Propertyshark